Intelligent risk prevention with Funk Beyond Insurance

Sensors, artificial intelligence, blockchain and other key technologies are already helping companies to reduce costs, increase productivity and create transparency across the entire value chain. Why shouldn't these technologies also help to reduce operational risks and make insurance management more efficient?

Discover practical examples now

With Funk Beyond Insurance, we actively use digitisation to implement intelligent risk management. Examples from our clients and technology partners show you what that looks like in practice.

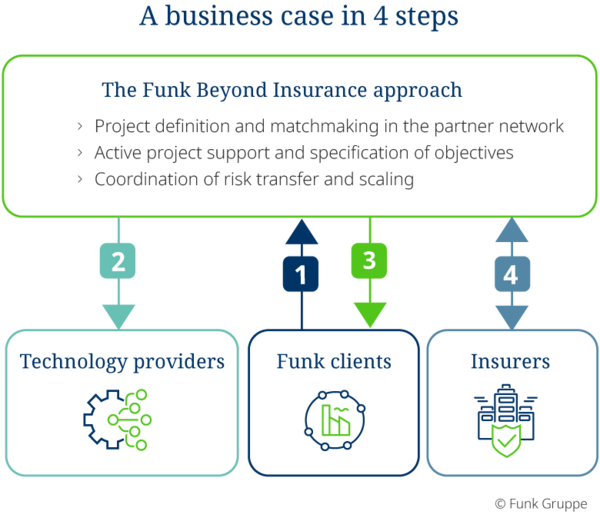

See the practical examplesFunk is addressing precisely this issue under the guiding concept of Funk Beyond Insurance: Here, we offer clients demonstrably suitable, beneficial and modern solutions within the framework of holistic consulting. In cooperation with a technology-oriented partner network, which includes established solution providers as well as innovative start-ups, Funk is already implementing initial solutions in practice.

The Beyond Insurance team always focuses on concrete challenges related to insurance-relevant risks. As a matchmaker, we show companies technical solutions that optimise their value creation and at the same time improve their business protection.

Funk Beyond Insurance in 2 minutes

In the German video, expert Manuel Zimmermann shows what distinguishes the Beyond Insurance concept and how Funk acts as a matchmaker for clients, technology providers and insurers.

Your added value

- Digitisation with a clear objective: loss prevention and risk reduction

- Side effects: process optimisations, cost reductions and increased efficiency

- Creation of future-proof infrastructures in the company for further innovations

- Medium and long-term access to innovative insurance products

Our services

- Central orchestrator of three structured networks: Funk clients, technology providers and the insurance industry

- Connecting our clients' challenges with innovative solutions

- Interweaving digitisation projects with innovative insurance approaches

- Decades of know-how from industrial insurance and risk consulting

How AI is reducing the risk of fire in the paper sector

The risk of fire is very high in the paper industry – ultimately the materials in this sector are highly flammable. An innovative defect and residual current monitoring solution allows for potential ignition sources to be detected early.

Learn more

Parametric insurance 4.0

In the context of digitisation, new fields of application are emerging for parametric insurance solutions. Soon, these could also be used in machinery breakdown insurance, for example.

Learn more

Do you want to speak with us about Funk Beyond Insurance?

Manuel Zimmermann | Dr Alexander Skorna

+49 40 35914-0