Analyse your business interruptions: Funk SMART BI-CHECK

In a world of networked supply chains, business interruptions can cause considerable financial damage. Management should therefore be aware of the worst-case scenario and take out business interruption insurance as required. A hardening of the market for such insurance creates additional challenges.

The poor loss ratios of recent years have put property insurers under pressure. As a result, a general hardening of the market with increased premiums can still be observed in property insurance. Fabian Konopka, Senior Consultant at Funk Consulting, says: “Another problem for policyholders is that insurers are increasingly lowering the limits for claims caused by contingencies and interdependencies as well as capacities per individual risk, meaning that insurance cover is not only more expensive in some cases, but also less comprehensive.”

Our solution approach

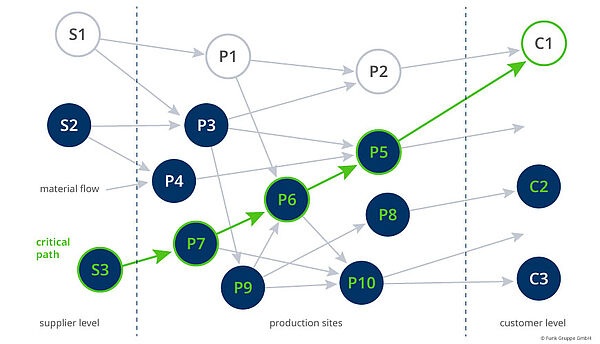

The Funk Smart BI Check identifies "critical paths" along the supply and value chains of your company. The following is determined as part of the analysis:

- Critical locations and production bottlenecks

- Critical products

- Critical suppliers

- Critical customers

For "critical paths", approaches to reduce dependencies and risks are developed together with your company.

The insurer Allianz/AGCS identifies the risk of business interruption as one of the most important risks for companies worldwide. Business interruption insurance primarily focuses on the risks of fire/explosion and natural hazards, which are becoming increasingly important due to the climate crisis. Regardless of the cause, the costs of business interruption contribute significantly to the overall loss.

Funk expert Fabian Konopka identifies three main cross-industry developments that particularly increase the risk of default:

- Globally integrated supply chains with low buffer stocks and redundancies

- Concentration of expertise and crucial production steps in a few key plants without overall improvements in fire protection or crisis management

- Increasing dependence on IT infrastructures that are permanently exposed to various forms of attack

Funk SMART BI-CHECK for more transparency regarding supply chain risks

While companies usually know their material assets for buildings, machinery, equipment, and inventories precisely, it is often difficult to localize gross profits at the site or fire complex level. Due to today's networked value creation, it is also important to determine internal and external dependencies. Funk Consulting analyses the value creation processes together with your company. In a qualified risk dialogue, the financially probable maximum loss due to the loss of critical suppliers, production sites, and bottleneck plants as well as critical purchasers is determined based on proven scenarios. "We look at the value creation processes on site, conduct risk dialogues and analyze dependencies and risks on this basis," says Fabian Konopka.

This provides your company with clarity about worst-case scenarios. Funk expert Fabian Konopka says: "A decisive side effect is also the support of the marketability of the property/accident risk. In a tough market for property insurance, transparency about the actual risk is a great added value for finding a suitable insurer consortium. In some cases, maximum indemnity amounts can also be reduced because companies are sometimes set up more redundantly due to their expansion. We are also seeing an increasing trend for insurers to expand the scope of insurance only after completing a BI analysis."

Your point of contact