When the boss has to put on wellies

Whether heavy rainfall or heat wave, risks posed by forces of nature and their consequences can cause long-term damage for companies, the more so as the intensity and frequency of such events increase. Modern risk management tools and tailor-made insurance solutions offer protection.

Whit Monday 2019: a heavy thunderstorm rumbles through the greater Munich area. Residents of the city report hailstones measuring up to six centimetres and more than 100,000 insurance claims for damage. Such extreme weather events – the negative consequences of which also affect companies – are not isolated cases. A number of scientific studies indicate that the damage potential of natural risks will continue to rise in future. Europe specifically should expect heavy rainfall, hailstorms and heat waves, while countries on other continents often have to deal with tropical storms or earthquakes and the secondary natural risks resulting from these events.

Always one step ahead of the weather

Whether in Germany or at subsidiaries abroad, companies should take these weather developments seriously and implement appropriate measures. ‘The first step is always to analyse the existing risk situation,’ says Lars Imbeck, a property insurance expert at Funk. ‘Geospatial data is used as a basis to determine which natural events pose an especially high risk to the client.’ After all, many risks, such as snow load, lightning strikes or earthquakes, directly depend on the geographical region.

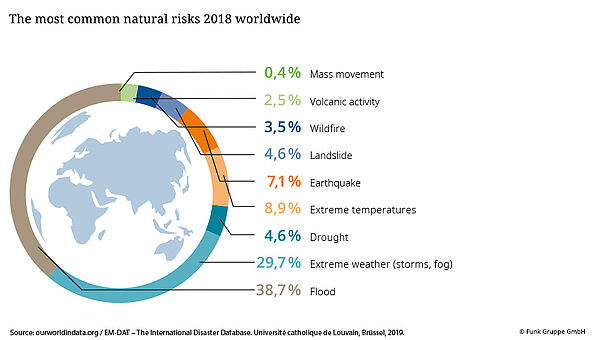

Secondary natural risks often arise as a consequence of a primary risk – a flood after a storm, for example – but can occur independently as well. Defined as small to medium yet especially frequent events, they are responsible for over half of the damage arising from natural risks.

The analysis focuses mostly on heavy rainfall and flooding, as these events occur especially frequently (events like what happened to automotive supplier Hörmann Automotive in Saarbrücken in June 2018). In terms of rainfall and flooding, insurers and consultants have been using the four ‘ZÜRS’ zones since as early as 2001. These zones are part of the geographical information system provided by the German Insurance Association (GDV). Based on risk maps and flood data, these zones indicate how often a region is affected by flooding, statistically speaking. ‘But these days, modern technology – drones, for example – is being used more and more to assess the flood risk of a location precisely, in addition to data from satellites or municipalities,’ Imbeck explains. These records are complemented where necessary with modern portal solutions that process the collected data. Often these tools can be integrated via interfaces in a company’s own applications and offer extra features in addition to risk assessment of different natural risks – features like estimating losses. As Imbeck says, ‘Through our in-house Funk Consulting, we offer personal services and digital tools in this respect. We also work closely with insurers. We are thus able to find the right risk management solution for every company.’

Taking local and international risks into consideration

Risk assessment takes place not just digitally, of course, but also directly on site through architects and engineers. After all, a building’s structural composition can make the difference when a storm, hail or snow comes. Roofs must also undergo regular maintenance in order to avoid damage. Precautions against flooding can be taken as well in concert with the municipality, and corresponding flood concepts developed, such as dykes and dams. Companies with subsidiaries abroad or with tight-knit supply chains should think beyond their own surroundings, however: ‘Professional supply chain management is crucial when it comes to natural disasters as well,’ emphasises Dr Alexander Skorna, Head of Business Development at Funk. While a volcano or typhoon poses no risk in Germany, the supply chain can quickly be crippled. Whether events are regional or international, business interruptions are often the result. ‘With tailored business continuity management, such as cooperative agreements that extend beyond the supply chain or the establishment of reserve capacities in the production process, companies can take precautions here as well,’ explains Skorna.

Insuring every risk explicitly

Once the risks are analysed they should be transferred, and this is especially true in the very unpredictable realm of natural risks. ‘The right insurance solution should include all of the results of the preceding risk assessment,’ Lars Imbeck says. Whether comprehensive all risk cover or an individual contract for a special regional risk, every natural risk must be explicitly insured in the contract in order to be able to enforce a claim. This is true both for primary risks and for damage arising from secondary risks or consequential damage, such as business interruptions.

Non-physical damage business interruptions (NDBI) are a special case: not every business interruption is caused by damage to the insured property of a company, a supplier or a customer. For example, a tight-knit supply chain can be disrupted when a flood causes a road to be blocked. Funk is your expert partner even in these NDBI cases.

Generally insurable natural risks are storms and hail, flooding, land subsidence, landslides and earthquakes, as well as tsunamis and volcanoes. Funk also offers special solutions in special cases, such as business interruptions suffered without property damage. Moreover, storm surges are generally excluded from typical contracts, but can be separately and specifically covered through parametric insurance solutions. For example, if certain wind speeds are exceeded, a claim is paid out regardless of whether damage was actually incurred. The tedious task of verifying the details of a claim is eliminated – a relief especially when it comes to locations abroad.

‘The limits of the insurers and thus the excess are based on the insurance requirements,’ Imbeck explains. The risk situation is crucial. An annual limit of indemnity is typically used, where all damages for the insured risks are totalled up to a financial cover limit. ‘Funk provides comprehensive advice to the client here, in order to find the right combination of limits and risk-minimising measures,’ Imbeck concludes. In the case of the hailstorm in Munich, three quarters of the damage caused by the hail were covered by insurance, but the best protection against natural risks remains risk prevention – so the boss can keep his or her leather shoes on instead of reaching for the wellies.

07.01.2020

Your point of contact