Protect against reputation risks the right way

A bad image can be expensive. Values such as reliability, responsibility and trust are therefore particularly worthy of protection for companies. Funk offers individual insurance and risk management solutions for the growing field of reputation risks.

‘It takes 20 years to build a reputation and five minutes to ruin it.’ That quote from investor Warren Buffett is more relevant now than ever.

‘Companies should take a close look at the extent to which insuring their reputation could protect them against financial losses in case of emergency.’

Media reporting on product defects, spectacular attacks by hackers or compliance breaches has made companies and risk managers sensitive to reputation damage. At the same time, topics like sustainability, environmental awareness and voluntary commitments are important pillars of sales and marketing. In short: The subject of corporate social responsibility is now firmly anchored in the strategy of many companies – in particular family-owned small and medium-sized enterprises.

If bad press or a PR crisis on social media threaten to damage their reputation, companies should also be in a position to act fast. Crisis management can get underway quickly with emergency planning developed in advance by corporate communication.

Particularly affected products and industries

A positive public image of companies and brands is naturally decisive for the success of products for private consumption. This is why food producers, automotive companies, chemical and pharmaceutical companies and electronics manufacturers take particular care to maintain a socially responsible and ecologically sustainable image. In the restaurant, hotel and tourism sector, too, a good reputation is relevant to the turnover and profits of a company.

In the business customer segment, the transport and logistics sector makes particular efforts to be perceived as sustainable. Dr Skorna says, ‘Long supply chains without transparency open the door to reputation damage – for example if child labour, inadequate fire protection, inhumane working conditions or deforestation of rainforests are revealed. These issues can often occur in upstream value-creation stages, e.g. in Asia or South America.’

Your point of contact

‘With reputation cover, companies can insure against lost profits or declines in revenue as a consequence of negative media reports and cover the costs of restoring their reputation.’

Insurance solutions to protect reputation

Events that damage reputation could be connected to an individual key figure, products and services, customers or corporate social responsibility.

A media event with potential to damage reputation is an essential element of reputation cover. This particularly applies to social media. This very broad insurance solution can also protect against lost reputation as a consequence of cyber attacks. Lars Heitmann says, ‘Similarly to cyber insurance, with insurance against damage to reputation Funk customers receive additional assistance services. These include, for example, professional crisis communication advice within a few hours of the damage event.’ The additional costs to restore reputation, in particular marketing and advertising costs, are also part of the cover.

Coverage concept reputation damage insurance

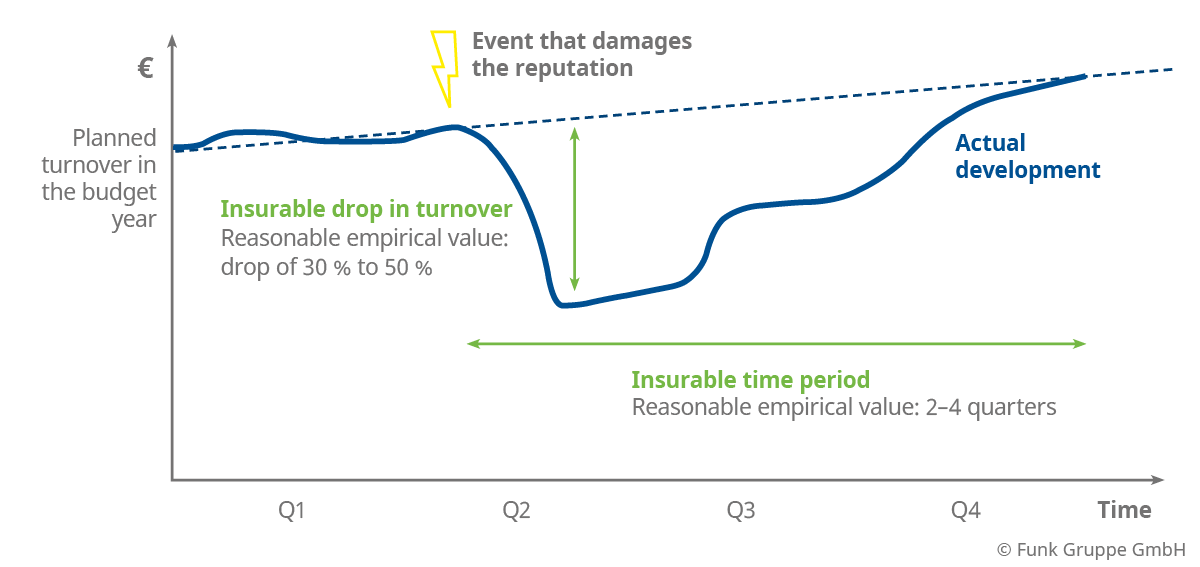

Continuous brand and media monitoring keeps an eye on the development of corporate reputation. A requirement for claim adjustment is a significant drop in returns compared to the previously defined planned figures. It must also be possible to link this loss back to the negative reporting. The damages payment is not linked to a specific purpose. That means the policy holder is free to choose what measures they select and implement to restore the company’s reputation as part of the crisis management.

Criminal and premeditated acts by defined representatives of the policy holder’s employees are excluded from the reputation cover. As a rule, this applies to the management board and the top level of management.

The experts at Funk provide support in the development of a tailored solution to secure reputation and provide advice on risk identification and evaluation, as well as the implementation of risk management measures.

11.07.2020