Why disputes about tariffs affect German companies, too

16.05.2018 - China and the USA have been flexing their muscles over punitive tariffs. As these two world powers fight for economic dominance, German SMEs are not shielded from the consequences. Companies can analyse the impact on their business with the ‘Funk political risk stress test’.

Europe can breathe easy for now: at least until June 2018 the EU will be protected from US tariffs under exception rules. And Chinese tariffs as yet have only singled out US products. The two world powers, in the meantime, are bobbing and weaving in a world trade boxing match that seems to escalate with each punch – and the effects are noticeable even in Germany.

By enforcing punitive tariffs the USA wants to protect its domestic industries and, above all, increase pressure on China to push forward internal reforms. These reforms include, for example, equal market access for foreign investors in China, the abolition of the joint venture requirement and the end of industrial espionage. China views these tariffs as an attack on its strategic growth. The trade war is getting in the way of Chinese plans to become the dominating force in ten important industrial fields of the future over the next ten years.

Affected products and industries

Individual countries can introduce tariffs in certain circumstances in order to protect their domestic industries and markets. An example of when this may be appropriate is when impermissible subventions from third countries lead to ‘dumping prices’ in the domestic market. In general, however, the associated tariffs are only permitted on a temporary basis.

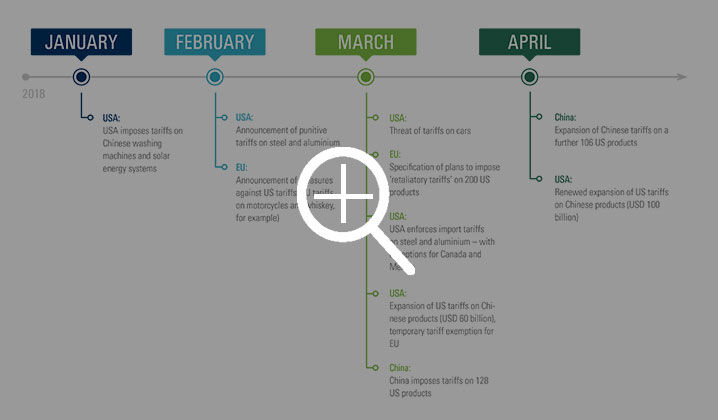

The ‘punitive tariffs’ employed now are about more than just protecting domestic industries. This is made clear by the products which are affected: the USA threw the first punch in this trade war in January when it levied tariffs on washing machines and solar energy systems from China. The Chinese are world market leaders in both of these industries. In mid-February the USA decided to enforce further import tariffs on steel and aluminium. This was the first punch with tariffs that crossed over into EU territory. The EU announced ‘retaliatory tariffs’ on products such as motorcycles, air conditioning units and orange juice, among others. The tactic was successful: the EU was able to gain exemption from US tariffs.

China responded in March and April with tariffs on US goods. Agricultural products in particular were affected: from soya beans, millet and corn to dried fruits, wine and pork. Dr Alexander Skorna, Business Development Manager at Funk, explains, ‘Global flows of trade will redistribute in the medium term because the USA is not able to meet domestic demand entirely through its own production network.’

USA, China and the EU: chronology of punitive tariffs

Effects on German SMEs

The international supply chains are closely networked and sometimes depend on individual local production capacities. ‘Although the EU has been more or less protected until now from punitive tariffs levied by the USA and China, the effects on Germany as the world’s third largest trading nation are serious,’ asserts Dr Skorna.

These effects are related above all to the products affected by the trade war: Chinese tariffs primarily aim to impact the strong US agricultural sector, while US tariffs are targeted at Chinese steel and consumer goods. There is therefore a risk that these goods are redirected to other markets, especially the EU, due to the increasing tariffs from both sides in future. Dr Alexander Skorna says, ‘The single European market is currently hardly protected from foreign imports and yet it is one of the world’s largest markets overall. Exports from China and the USA to the single European market would increase, and the result would be a stark drop in prices.’

As the largest individual market and the largest trading nation in the single European market, Germany would be especially impacted by developments such as this. The indirect effects of punitive tariffs particularly touch on German agriculture, the German food industry, and Germany’s steel and aluminium industries and downstream refining sectors. ‘They will have to overcome reduced margins and increased cost pressure,’ Dr Skorna predicts.

While huge enterprises carry out their value-adding processes on a global scale, these economic developments pose big challenges to German SMEs in particular. ‘Production is still concentrated in Germany many times over, and like the German domestic market, the entire single European market is still very important for SMEs,’ says Dr Skorna.

Political risks threaten business success

The current dispute over punitive tariffs shows that political risks are not just limited to military wars and terrorism. Risks brought on by economic ambitions or changed legislation are also a factor.

‘In the case of tariffs, companies can find products on capital markets that protect the prices of raw materials and established agricultural products through selected hedging instruments,’ explains Dr Skorna. ‘Insurance solutions for political risks, however, only exist within very strict limits in terms of protection against price drops.’

For this reason it is all the more important for companies to have a clear picture of what risks may affect their liquidity and capitalisation. They should prepare for possible scenarios in a targeted way and implement measures to reduce risk.

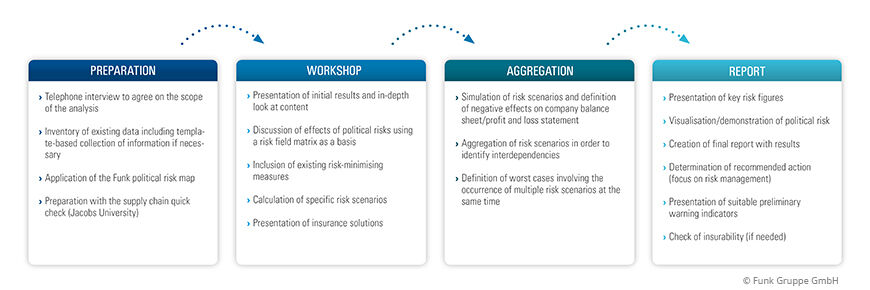

How the ‘Funk political risk stress test’ works:

During the preparation phase of the stress test, a risk assessment is conducted, which defines the key risks and the countries to be considered. Country-specific risks and relevant risks and scenarios are analysed with the client. Using the RIMIKS risk simulation software, these developed risk scenarios are put in the context of the company’s planning. Through this process, companies know upon completing the workshop specifically how business figures will be affected, if for example a plant in Tunisia fails or a supplier from Ukraine is no longer available. Possible measures for managing the risk are also discussed and summarised in a recommendation catalogue in the final report.

Your point of contact